Page 458 - Webbook_aus_04

P. 458

raw / plate / small

Reality

produc

e

r

① System provision (ERP, super manager , producer account , shopping mall ,

homepage , SNS system provided )

② Receive products on the condition of providing the system and make a profit by

selling the products provided. The method is to sell directly Because the state provide

s a distributor business, it is a business that can help producers.

seller

① Provides a system that allows salespeople to easily sell products

② We provide products to salespeople so that they can receive many products at a

lower price than other suppliers. supplies .

③ Numeric domain advertising is provided so that salespeople can more easily promote

tangible and intangible products .

④ Selling just one thing has the same effect as selling ten , a hundred , or a thousand things .

⑤ If you sign up as a member only once, the profits will continue to be earned as long as

the member uses It is provided .

⑥ When a person with a numeric domain places a product in a store and becomes an

MD , the product is sold on hawk Profit is given whenever possible .

⑦ All sales in the world , including movies and entertainment , are placed on the GA

platform and sold through the. Then, you receive CP profits whenever each product is sold .

⑧ When a person with a GA number domain increases members, the platform can be ea

sily provided to users. number of lines have do .

⑨ Promote the benefits of providing the system to users and encourage their members

make Helps you pay .

⑩ A person who has a numeric domain can transfer and transfer the rights to profits

earned through his or her efforts .

⑪ You can receive key money .A certain amount of money is received from salespeople

in exchange for 11 types of preferential treatment. This amount is the same as in

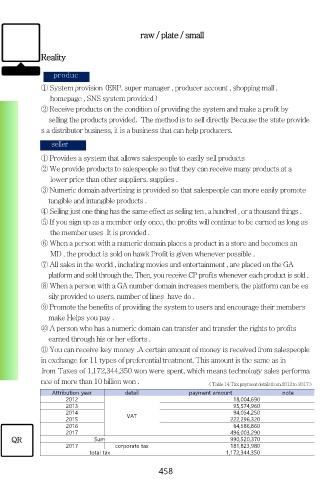

from Taxes of 1,172,344,350 won were spent, which means technology sales performa

nce of more than 10 billion won . < Table 14 Tax payment details from 2012 to 2017 >

Attribution year detail payment amount note

2012 18,004,690

2013 95,574,960

2014 VAT 94,054,250

2015 222,296,320

2016 64,586,860

2017 496,003,290

QR Sum 990,520,370

2017 corporate tax 181,823,980

total tax 1,172,344,350

458