Page 47 - Webbook_aus_05

P. 47

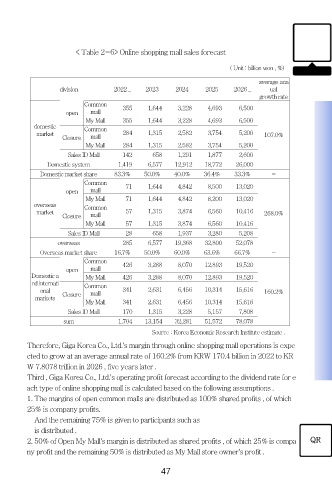

< Table 2-6> Online shopping mall sales forecast

( Unit : billion won , %)

average ann

division 2022 _ 2023 2024 2025 2026 _ ual

growth rate

Common 355 1,644 3,228 4,693 6,500

open mall

My Mall 355 1,644 3,228 4,693 6,500

domestic Common

market 284 1,315 2,582 3,754 5,200 107.0%

Closure mall

My Mall 284 1,315 2,582 3,754 5,200

Sales ID Mall 142 658 1,291 1,877 2,600

Domestic system 1,419 6,577 12,912 18,772 26,000

Domestic market share 83.3% 50.0% 40.0% 36.4% 33.3% -

Common 71 1,644 4,842 8,500 13,020

open mall

My Mall 71 1,644 4,842 8,200 13,020

overseas Common

market 57 1,315 3,874 6,560 10,416 268.0%

Closure mall

My Mall 57 1,315 3,874 6,560 10,416

Sales ID Mall 28 658 1,937 3,280 5,208

overseas 285 6,577 19,368 32,800 52,078

Overseas market share 16.7% 50.0% 60.0% 63.6% 66.7% -

Common 426 3,288 8,070 12,893 19,520

open mall

Domestic a My Mall 426 3,288 8,070 12,893 19,520

nd internati Common

onal mall 341 2,631 6,456 10,314 15,616 160.2%

markets Closure

My Mall 341 2,631 6,456 10,314 15,616

Sales ID Mall 170 1,315 3,228 5,157 7,808

sum 1,704 13,154 32,281 51,572 78,078

Source : Korea Economic Research Institute estimate .

Therefore, Giga Korea Co., Ltd.'s margin through online shopping mall operations is expe

cted to grow at an average annual rate of 160.2% from KRW 170.4 billion in 2022 to KR

W 7.8078 trillion in 2026 , five years later .

Third , Giga Korea Co., Ltd.'s operating profit forecast according to the dividend rate for e

ach type of online shopping mall is calculated based on the following assumptions .

1. The margins of open common malls are distributed as 100% shared profits , of which

25% is company profits.

And the remaining 75% is given to participants such as

is distributed .

2. 50% of Open My Mall's margin is distributed as shared profits , of which 25% is compa QR

ny profit and the remaining 50% is distributed as My Mall store owner's profit .

47