Page 59 - Webbook_aus_05

P. 59

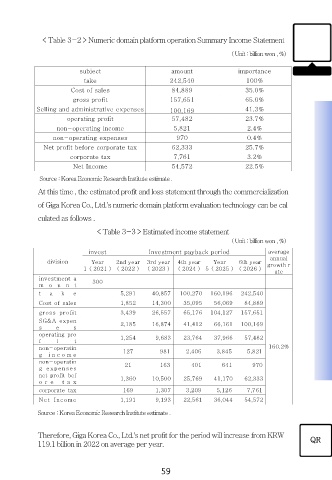

< Table 3-2 > Numeric domain platform operation Summary Income Statement

( Unit : billion won , %)

subject amount importance

take 242,540 100%

Cost of sales 84,889 35.0%

gross profit 157,651 65.0%

Selling and administrative expenses 100,169 41.3%

operating profit 57,482 23.7%

non-operating income 5,821 2.4%

non-operating expenses 970 0.4%

Net profit before corporate tax 62,333 25.7%

corporate tax 7,761 3.2%

Net Income 54,572 22.5%

Source : Korea Economic Research Institute estimate .

At this time , the estimated profit and loss statement through the commercialization

of Giga Korea Co., Ltd.'s numeric domain platform evaluation technology can be cal

culated as follows .

< Table 3-3 > Estimated income statement

( Unit : billion won , %)

invest Investment payback period average

annual

division Year 2nd year 3rd year 4th year Year 6th year growth r

1 ( 2021 ) ( 2022 ) ( 2023 ) ( 2024 ) 5 ( 2025 ) ( 2026 )

ate

investment a 300

m o u n t

t a k e 5,291 40,857 100,270 160,196 242,540

Cost of sales 1,852 14,300 35,095 56,069 84,889

gross profit 3,439 26,557 65,176 104,127 157,651

SG&A expen 2,185 16,874 41,412 66,161 100,169

s e s

operating pro 1,254 9,683 23,764 37,966 57,482

f i t

non-operatin 127 981 2,406 3,845 5,821 160.2%

g i n c o m e

non-operatin

g expenses 21 163 401 641 970

net profit bef

o r e t a x 1,360 10,500 25,769 41,170 62,333

corporate tax 169 1,307 3,209 5,126 7,761

Net Income 1,191 9,193 22,561 36,044 54,572

Source : Korea Economic Research Institute estimate .

Therefore, Giga Korea Co., Ltd.'s net profit for the period will increase from KRW

119.1 billion in 2022 on average per year. QR

59