Page 62 - Webbook_aus_05

P. 62

Seventh , the increase/decrease in working capital and working capital were calculate

d as follows .

Working capital refers to the funds needed for business activities and refers to net wo

rking capital .

It refers to the portion of current assets excluding current liabilities In this analysis, th

e 2019 Corporate Management Analyst 16)

The average inventory turnover ratio (17.21) and accounts receivable of the mail ord

er business

The increase/decrease in working capital was calculated by multiplying the increase/d

ecrease in sales by the working capital requirement rate of 5.34% calculated using the

accounts receivable turnover ratio (11.27 ) and accounts payable turnover ratio

(10.70) .

< Working capital requirement rate and working capital increase/decrease amount Calculation formula >

Working capital requirement = 1/ Inventory turnover rate + 1/ Accounts receivable turno

ver rate – 1/ Accounts payable turnover rate Working capital increase/decrease = increas

e/decrease in sales × Working capital requirement

The increase or decrease in working capital can be calculated by multiplying the incre

ase or decrease in sales by the working capital requirement rate . Working capital can

be calculated as the accumulated amount of working capital increase or decrease .

At this time , the annual working capital and the increase or decrease in working capit

al can be calculated as follows .

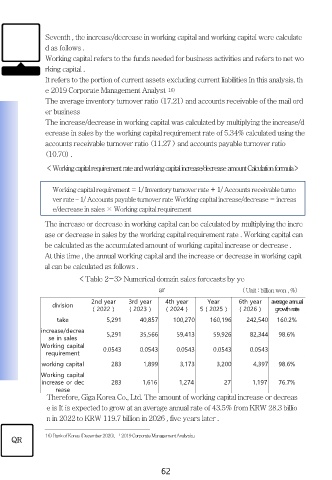

< Table 2-3> Numerical domain sales forecasts by ye

ar ( Unit : billion won , %)

2nd year 3rd year 4th year Year 6th year average annual

division

( 2022 ) ( 2023 ) ( 2024 ) 5 ( 2025 ) ( 2026 ) growth rate

take 5,291 40,857 100,270 160,196 242,540 160.2%

increase/decrea 5,291 35,566 59,413 59,926 82,344 98.6%

se in sales

Working capital 0.0543 0.0543 0.0543 0.0543 0.0543

requirement

working capital 283 1,899 3,173 3,200 4,397 98.6%

Working capital

increase or dec 283 1,616 1,274 27 1,197 76.7%

rease

Therefore, Giga Korea Co., Ltd. The amount of working capital increase or decreas

e is It is expected to grow at an average annual rate of 43.5% from KRW 28.3 billio

n in 2022 to KRW 119.7 billion in 2026 , five years later .

16) Bank of Korea (December 2020), 「 2019 Corporate Management Analysis」

QR

62