Page 64 - Webbook_aus_05

P. 64

(3-4)

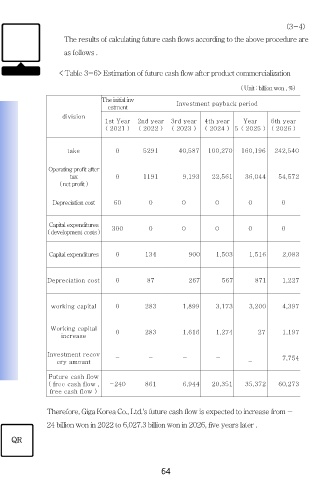

The results of calculating future cash flows according to the above procedure are

as follows .

< Table 3-6> Estimation of future cash flow after product commercialization

( Unit : billion won , %)

The initial inv Investment payback period

estment

division

1st Year 2nd year 3rd year 4th year Year 6th year

( 2021 ) ( 2022 ) ( 2023 ) ( 2024 ) 5 ( 2025 ) ( 2026 )

take 0 5291 40,587 100,270 160,196 242,540

Operating profit after

tax 0 1191 9,193 22,561 36,044 54,572

( net profit )

Depreciation cost 60 0 0 0 0 0

Capital expenditures

( development costs ) 300 0 0 0 0 0

Capital expenditures 0 134 900 1,503 1,516 2,083

Depreciation cost 0 87 267 567 871 1,227

working capital 0 283 1,899 3,173 3,200 4,397

Working capital 0 283 1,616 1,274 27 1,197

increase

Investment recov - - - - 7,754

ery amount -

Future cash flow

( free cash flow , -240 861 6,944 20,351 35,372 60,273

free cash flow )

Therefore, Giga Korea Co., Ltd.'s future cash flow is expected to increase from -

24 billion won in 2022 to 6,027.3 billion won in 2026, five years later .

QR

64