Page 53 - ESSAYBCTO ENG 6nd

P. 53

Therefore, Giga Korea Co., Ltd.'s overseas infrastructure and agency operating profit

is expected to grow at an average annual rate of 268.0% from KRW 13.9 billion in

2022 to KRW 2,537.1 billion in 2026 , five years later .

2. Resale sales

Resale sales were made based on the following assumptions :

1. This is fee income for exchange operations, such as number domains between con

sumers .

2. Here, resale is limited to numeric domain items .

3. Resale is assumed to account for 10% of total cumulative sales each year .

4. The transaction fee is set at 1.5% .

5. For numerical wholesaler sales, please refer to < Table 2-4> .

At this time , resale sales can be calculated as follows .

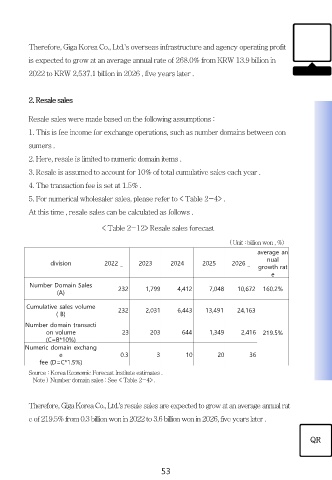

< Table 2-12> Resale sales forecast

( Unit : billion won , %)

average an

nual

division 2022 _ 2023 2024 2025 2026 _

growth rat

e

Number Domain Sales 232 1,799 4,412 7,048 10,672 160.2%

(A)

Cumulative sales volume 232 2,031 6,443 13,491 24,163

( B)

Number domain transacti

on volume 23 203 644 1,349 2,416 219.5%

(C=B*10%)

Numeric domain exchang

e 0.3 3 10 20 36

fee (D=C*1.5%)

Source : Korea Economic Forecast Institute estimates .

Note ) Number domain sales : See < Table 2-4> .

Therefore, Giga Korea Co., Ltd.'s resale sales are expected to grow at an average annual rat

e of 219.5% from 0.3 billion won in 2022 to 3.6 billion won in 2026, five years later .

QR

53