Page 65 - Webbook_aus_05

P. 65

Chapter 4 Business Value Evaluation

Section 1 Calculation of discount rate

The discount rate for evaluating the company's technology value was calculated as

follows by applying the discount rate for unlisted medium- sized companies

corresponding to the Korean Standard Industrial Classification G47 industry ( re

tail business ) in the technology value evaluation practical guide published by the

17)

Ministry of Trade, Industry and Energy in 2017 .

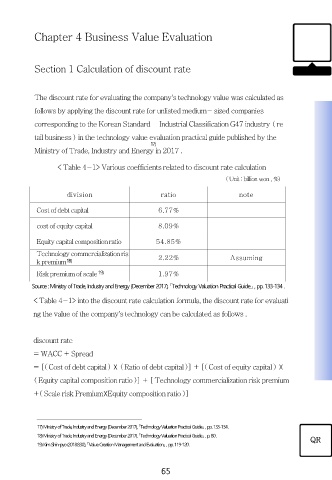

< Table 4-1> Various coefficients related to discount rate calculation

( Unit : billion won , %)

division ratio note

Cost of debt capital 6.77%

cost of equity capital 8.09%

Equity capital composition ratio 54.85%

Technology commercialization ris

k premium 18) 2.22% Assuming

Risk premium of scale 19) 1.97%

Source : Ministry of Trade, Industry and Energy (December 2017), 「Technology Valuation Practical Guide」 , pp. 133-134 .

< Table 4-1> into the discount rate calculation formula, the discount rate for evaluati

ng the value of the company's technology can be calculated as follows .

discount rate

= WACC + Spread

= [( Cost of debt capital ) ☓ ( Ratio of debt capital )] + [( Cost of equity capital ) ☓

( Equity capital composition ratio )] + [ Technology commercialization risk premium

+( Scale risk Premium☓Equity composition ratio )]

17) Ministry of Trade, Industry and Energy (December 2017), 「Technology Valuation Practical Guide」 , pp. 133-134 .

18) Ministry of Trade, Industry and Energy (December 2017), 「Technology Valuation Practical Guide」 , p. 80 .

19) Kim Shin-pyo (2018.8.30.), 「Value Creation Management and Evaluation」 , pp. 119-120 . QR

65